The country’s Letter of Credit payments dropped to $391.91m from $912.35m within the same period in 2023.

According to the CBN’s weekly International Payments Data published on its website, the country’s Letter of Credit payments dropped to $391.91m from $912.35m within the same period in 2023.

A Letter of Credit is a mode of payment used for the importation of visible goods. It is a written undertaking given by s bank (issuing bank) at the request of its customer in which the bank promises in writing to pay the exporter a certain sum within a certain time frame in return for goods, as long as the customer provides the bank with the proper paperwork.

In the period under review, the country’s LCs payment shed about $520.44m.

An analysis of the CBN data showed that the highest LC payments this year were recorded in February at $102.59m, followed by July at $79.65m and $58.33m in January.

In March, LCs payments stood at $43.53m compared to $269m in the same month in 2023, rose to $54.02m in April 2024 and dropped to $21.48m in May before rising to $32.26m in June.

The development comes following the sale of about $122.67m to 46 authorised dealers by the CBN, in its determination to promote stability and reduce market volatility in the foreign exchange market.

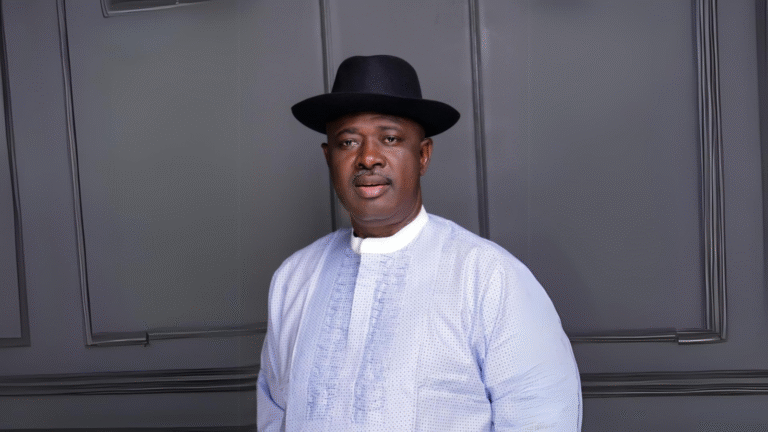

A statement signed by the Bank’s Director in charge of Financial Markets, Dr. Omolara Duke, disclosed that of the total sale, $67,500m was sold to 27 dealers, while the sum of US$2.5m was bought from one authorised dealer on July 10, 2024.

The range of the bid for the July 10, 2024 sales was ₦1,480.0/US$- ₦1,500.0/US$, while the value date for the payments, going by the settlement cycle of two days, is July 12, 2024.

Similarly, on July 11, 2024, the sum of $55,171m was sold to 19 authorised dealers at ₦1,540.0/US$, and no FX was purchased. The value date for the payments of the spot sale is July 15, 2024.

Channels