Foreign exchange market speculators are at the receiving end of fresh regulatory actions aimed at stabilising the exchange rate, FELIX OLOYEDE writes

The exchange rate plays a significant role in every economy, as many factors driving economic growth are linked to it. Nigeria relies heavily on imports for most manufactured goods, highlighting the necessity of a stable and transparent foreign exchange system.

For the Central Bank of Nigeria, for some years now, of all the monetary challenges the country has been grappling with, foreign exchange and high inflation have been the elephant in the room.

The country’s inflation accelerated to 34.8 per cent in December 2024 but fell to 24.48 per cent in January this year, after the National Bureau of Statistics rebased the consumer price index. It further declined to 23.18 per cent in February but rose again in March to 24.23 per cent.

The insecurity in the country’s food-producing regions has been linked to high inflation rates.

Analysts project that if the government addresses the country’s security challenges, food inflation—which is a major contributor to rising prices—will decrease, leading to a significant reduction in overall inflation.

In the last two years, the local currency has shed 248.98 per cent of its value, from N460.94/$ on May 8, 2023, to N1,608.60/$ on May 7, 2025, at the Nigerian Foreign Exchange Market.

Before now, the country’s foreign exchange market was characterised by a lack of transparency and widespread round-tripping and acute scarcity of dollars.

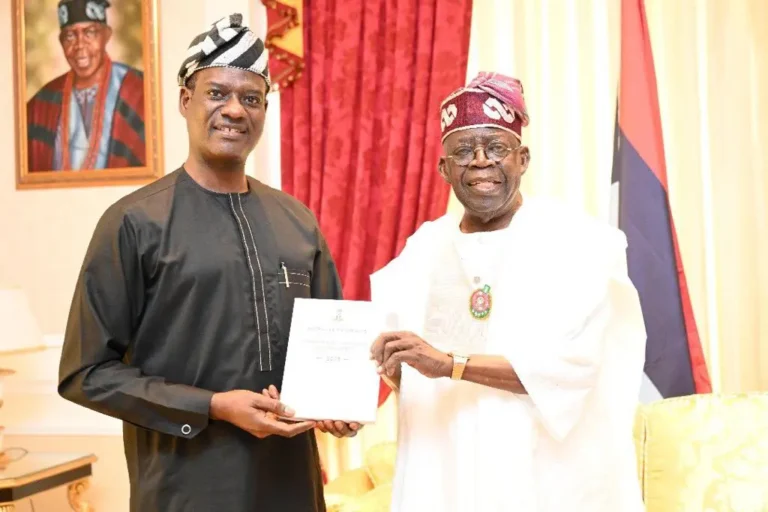

On September 15, the day the incumbent CBN Governor, Olayemi Cardoso, assumed office, the dollar exchanged for N955/$ on the black market and was sold for N785.39/$ at the official market, creating N169.61, and making speculators smile to the bank without breaking a sweat.

Meanwhile, manufacturers struggled to access foreign exchange, as the Central Bank grappled with a forex backlog exceeding $7bn, further deepening uncertainty in the market.

On June 14, 2023, the CBN floated the naira, allowing market forces of supply and demand to determine its value—aiming to reduce the government’s burden of defending the currency and to restore confidence in the foreign exchange market.

The policy aimed to conserve resources previously used to defend the local currency.

This initiated a series of reforms by the CBN to enhance the country’s forex market, stabilise the local currency, and tighten control against speculators who had previously been thriving.

Although the flotation of the naira led to a loss of nearly 54 per cent of its value in 2024, it dropped from 997/$ on December 31, 2023, to N1,535 at the close of business on December 31, 2024, it dismantled the multiple exchange rates in the forex market, made speculation to thrive, improved liquidity in the market and reduced the spread between the official and alternative markets.

On Wednesday, the dollar was sold for N1,608.60/$ at the Nigerian Foreign Exchange Market and N1,620/$ at the black market, according to abokiforex.com, an online forex monitoring platform.

Some of the reforms that have been launched by the CBN under Cardoso to improve the forex market are: the Electronic FX Matching System (B-Match), which was introduced to improve price discovery and transparency in forex transactions and the Nigeria Foreign Exchange Code, which was established to enhance transparency and efficiency in the forex market.

The different reforms initiated by the CBN have helped narrow the gap between the official and alternative markets.

CBN position

Commenting on the development, CBN Governor Olayemi Cardoso noted that the renewed stability in the exchange rate has helped restore market confidence and encouraged increased autonomous forex inflows through official channels.

He explained that those inflows were broadening Nigeria’s foreign exchange sources beyond oil, with significant contributions from diaspora remittances and export earnings.

The improved exchange rate stability has drawn praise from market observers, including the globally recognised Fitch Ratings, which recently upgraded Nigeria’s credit outlook. Fitch cited key reforms such as the unification of exchange rates to curb arbitrage, the launch of an electronic FX matching platform, the introduction of a new FX code to enhance transparency and efficiency, and tighter monetary policy aimed at curbing inflation.

Cardoso said, “The numbers speak for themselves. The difficult reforms that were undertaken have begun to bear fruit. The orthodox monetary policy is a route we can’t compromise on. By adopting orthodox monetary policy, we have been able to stabilise the macroeconomic credentials of the economy.”

He noted that the apex bank had strengthened its monetary buffers and positioned Nigeria to better withstand external shocks.

“Indeed, the macroeconomic stability we are beginning to see today would not have been possible without these decisive actions. Nigeria’s external buffers have also strengthened considerably. Our foreign reserves now exceed $38bn, providing nearly 10 months of import cover. This robust buffer enables us to better withstand external shocks – whether from declining oil prices or global financial turbulence- thereby safeguarding our economy,” Cardoso explained.

According to the CBN boss, in 2024, Nigeria recorded a balance of payments surplus of $6.83bn, the strongest in many years, driven by rising exports and renewed capital inflows.

“At the same time, we are enhancing the strength of our financial sector. The banking sector recapitalisation is well underway, with strong momentum and stakeholder alignment, and will ensure that Nigerian banks are fully equipped to support the real economy with greater scale, stability, and capacity.

“At these Spring Meetings, our development partners expressed their confidence in Nigeria’s trajectory. Feedback from global investors and the Nigerian diaspora has likewise been overwhelmingly positive, reflecting growing alignment with our economic direction.

“Nigeria is increasingly recognised as a rising economic force, admired for the resolve shown in implementing difficult but necessary reforms. These achievements, while encouraging, only strengthen our resolve to press forward. We will not be complacent. Instead, we will redouble our efforts to ensure these positive trends are sustained,” he enunciated.

Cardoso acknowledged that the reforms were not easy but emphasised that they were beginning to yield results, adding that the country had shifted from a position of vulnerability to one of increasing strength, with signs of a positive economic trajectory emerging.

Wooing investors

Speaking at the recently concluded Spring Meetings of the IMF/World Bank Group in Washington, D.C., during the Nigeria Investor Forum organised by JP Morgan, CBN Governor Olayemi Cardoso stated that the adoption of orthodox monetary policy would be sustained, as it has guided the economy through a challenging period toward greater stability.

He noted that foreign investors have taken notice of those policy reforms and had increased both their investments and commitments in Nigeria’s domestic economy.

Cardoso emphasised efforts to remove bottlenecks hindering investment flows and to narrow the gaps in the exchange rate. He also highlighted outreach to the Nigerian diaspora, who are now showing greater interest in contributing to the economy.

He acknowledged that while this is a period of heightened global uncertainty, the Central Bank has—over the past 18 months—managed to strengthen the economy through a series of tough but necessary decisions.

According to the apex bank boss, Nigeria has a competitive naira, which is a game changer that should attract investors to the economy. He said that with a competitive naira, FDIs inflows prospects for the economy have risen.

He said the ease of doing business was being worked on, and that will further support investment inflows.

JP Morgan also disclosed that in the coming months, it would be applying to the CBN for a merchant banking licence.

In a report detailing its African expansion strategy, American banking giant JP Morgan announced plans to upgrade its representative office in Lagos into a full-service branch, advancing the CEO’s vision to deepen the bank’s footprint across the continent.

Having maintained a presence in Lagos since the 1980s, JP Morgan is now poised to scale up its operations in Nigeria.

“The New York-based financial institution, managed in Nigeria by Dapo Olagunju, will apply to the Central Bank of Nigeria, CBN, for a merchant banking licence in the coming months,” the report said.

JP Morgan’s new US-Nigeria entity is poised to offer dollar loans to major corporations, complementing its advisory and asset management services.

This move is part of the bank’s strategy, led by CEO Jamie Dimon, to expand its African presence.

Dimon’s recent visits to Nigeria, South Africa, and Kenya underscore this ambition. Having already opened offices in Abidjan and Nairobi, JP Morgan aims to deepen its footprint on the continent by supporting countries in Eurobond issuances, as seen in Nigeria’s 2024 international fundraising.

JP Morgan Index return

The Director-General of the Debt Management Office said Nigeria had started discussions with JP Morgan to re-enter the Government Bond Index and renew investors’ confidence.

Nigeria has recently received favourable credit assessments from rating agencies due to the significant reforms initiated by the CBN.

Fitch Ratings upgraded the Long-Term Issuer Default Ratings of seven Nigerian banks and two bank holding companies to ‘B’ from ‘B-‘, reflecting that the outlooks are stable.

The upgrades of the Long-Term IDRs of the banks followed the recent sovereign upgrade and reflect Fitch’s view that Nigeria’s sovereign credit profile has become less of a constraint on the issuers’ standalone creditworthiness, the rating agency said.

On April 11, Fitch upgraded Nigeria’s Long-Term IDRs to ‘B’ from ‘B-’, reflecting growing confidence in the government’s commitment to policy reforms. These reforms, initiated in June 2023, include exchange rate liberalisation, tighter monetary policy, ending deficit monetisation, and removing fuel subsidies.

“These have improved policy coherence and credibility and reduced economic distortions and near-term risks to macroeconomic stability, enhancing resilience in the context of persistent domestic challenges and heightened external risks,” Fitch said.

Nigeria was removed from the JP Morgan index in 2015 due to its deviation from conventional monetary policies and the influence of capital controls on its foreign exchange management.

Due to a decrease in oil revenues, Nigeria implemented currency restrictions to protect the naira after it experienced a significant decline, leading to the depletion of dollar reserves. The central bank had previously advised Nigeria to restore liquidity in its currency market to enable foreign investors tracking the index to conduct transactions with minimal obstacles.

“Foreign investors who track the GBI-EM series continue to face challenges and uncertainty while transacting in the naira due to the lack of a fully functional two-way FX market and limited transparency,” the bank said in a 2015 note.

Economic prospects

Nigeria’s economy is already exiting the most painful phase of the reform adjustment process in 2025, according to a Non-Executive Director of Parthian Partners, Bismarck Rewane.

He forecasted economic recovery by 2025, following the most challenging phase of reform adjustments, stressing the need for strategic policy execution and institutional reforms.

“Revenue alone is not enough. Investment is key, but it will be influenced by confidence, transparency, and the right policies,” Rewane noted.

He highlighted ongoing challenges, including power supply issues and a lack of transparency in the oil and gas sector, which need urgent structural reforms.

However, he expressed optimism for 2025, predicting a less arduous year compared to the previous one, and emphasising that the difficulties experienced in 2024 won’t necessarily persist.

The CEO of NGX Regulation Limited, Olufemi Shobanjo, emphasised the importance of liquidity in capital markets, highlighting initiatives that boost investor confidence and promote market stability.

The apex bank has taken proactive steps to combat inflation, recently hosting the 2025 Monetary Policy Forum. The event brought together key stakeholders to discuss “Managing the Disinflation Process.”

The CBN governor emphasised the bank’s focus on sustaining price stability, transitioning to an inflation-targeting framework, and implementing strategies to boost purchasing power and alleviate economic hardship.

He added that the CBN remained committed to disciplined monetary policy, aiming to curb inflation and stabilise the economy.

“These actions have yielded measurable progress: relative stability in the FX market, narrowing exchange rate disparities, and a rise in external reserves to over $40bn as of December 2024.

The CBN also focused on strengthening the banking sector, introducing new minimum capital requirements for banks (effective March 2026) to ensure resilience and position Nigeria’s banking industry for a $1tn economy,” he said.

PUNCH.