The Chairman of the Delta State Internal Revenue Service, Hon. Solomon Ighrakpata has revealed that the Service has achieved a landmark performance in respect of Internally Generated Revenue (IGR) collected in the first half of the 2025 fiscal year.

Ighrakpata, who made this known to newsmen in a statement, stated that the internally generated revenue of the state hit an unprecedented N104 billion milestone in the first half of the 2025 Fiscal year, exceeding a projected 77% of the annual revenue target for the year.

The Revenue Service Chief also disclosed that the sum of One Hundred and Four Billion, Eighty Million, Six Hundred and Three Thousand, Eight Hundred and Twenty -Six Naira and Seventy-Four Kobo (N 104,080,603,826.74) was collected for the period of January, 2025 to June, 2025.

Hon. Ighrakpata reiterated that the revenue is against the sum of Seventy-Eight Billion, Seventeen Million, Five Hundred and forty-Six Thousand, Seventy-One Naira and Six Kobo (N78,017,546,571.06) collected for the same period in 2024, with a positive variance of Twenty-Six Billion, Sixty-Three Million, Fifty-Seven Thousand, Two Hundred and Fifty- five Naira and sixty-Eight Kobo (N26,063,057,255.68) or 133.41% performance rate.

He further declared that, “With the Cumulative IGR collection figure of One Hundred and Four Billion, Eighty Million, Six Hundred and Three Thousand, Eight Hundred and Twenty -Six Naira and Seventy-Four Kobo ( N 104,080,603,826.74) for the period of January to June, 2025, the Revenue Service has achieved approximately 77,62 % of the Annual Revenue target of One Hundred and Thirty-four Billion, Ninety-Two Million, Eight Hundred and Forty-Eight Thousand, One Hundred and Nine Naira ( N134,092,848,109.00) in the 2025 budget estimate.”

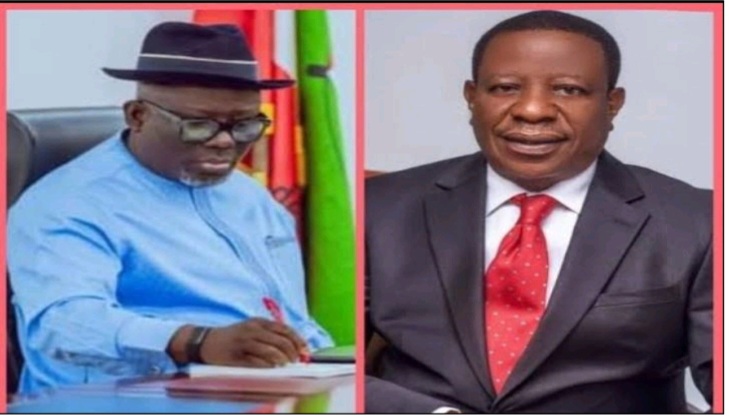

Ighrakpata who expressed hope that the Service would surpass the revenue target for the fiscal year, attributed the factors responsible for the success story to include, amongst others; the judicious use of the taxpayers’ monies to execute landmark projects across the three Senatorial Districts of the State by the State Governor, Rt. Hon. Sheriff Oborevwori and the team work by the Board members and management of the Service.

He also lauded the technical support by lead Consultants to the Service, ICMA Professional Services and Zopaz Advisory Services for their commitment to IGR drive in the State.

Ighrakpata also went on to acknowledge the engagements with relevant stakeholders, sensitization and education of taxpayers, implementation of whistle blower policy and the constitution of the Executive Chairman’s Intelligence Gathering and Compliance Monitoring Unit and Tax Investigation Unit, effective utilization of Tax Audit Review Committee (TARC) meeting for reconciliation or speedy resolution of tax liabilities objections, amongst others, as steps taken by the Board to achieve the desired outcomes.

The Revenue Service helmsman further expressed his heartfelt gratitude to all relevant stakeholders including the Ministries, Departments and Agencies of the Federal and State Governments, Security Agencies, the Organized Private Sector, Professional Bodies, Unions, Trade Associations, Business Groups, Traditional Institutions, Local Government Authorities and others, who have continued to partner with the Service by dutifully performing their civic responsibility of paying their due taxes to the Delta State Government.

He pointed out that the development has greatly assisted the Service to shore up the IGR, which has, undoubtedly, translated into the provision of funds needed to execute more people-oriented projects by the Government of Rt. Hon. Sheriff Oborevwori under M.O.R.E Agenda.