The Chairman of Manufacturers Association of Nigeria (MAN) in Ogun State, George Onafowokan, yesterday re-echoed myriad of challenges confronting the manufacturing sector, saying producers now operate under intense pressure following the sector’s decline due to rising inflation, naira depreciation, high interest rates, and escalating energy cost.

This is even as he expressed concern over the declining contribution of the manufacturing sector to Nigeria’s Gross Domestic Product (GDP), which fell from 16.04% in Q4 2023 to 12.68% by mid-2024.

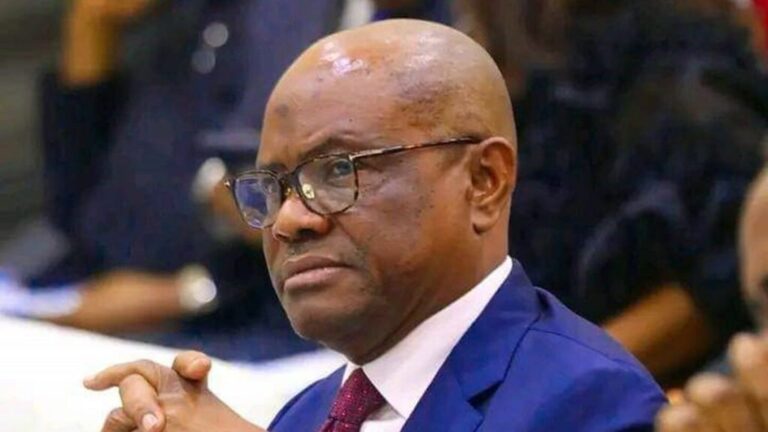

Onafowokan spoke during the Private Session of the 40th Annual General Meeting (AGM) of the Ogun MAN branch on Thursday.

At the AGM, Onafowokan who is the Managing Director and CEO of Coleman Wires and Cables Industries Limited, was re-elected as Chairman of the Ogun MAN branch for a third consecutive term, along with other members of the executive.

In his address, the Chairman attributed the sector’s decline to rising inflation, naira depreciation, high interest rates, and escalating energy costs, which he said have significantly increased production expenses, reduced consumer spending, and eroded profit margins.

“Manufacturers are operating under intense pressure. Consumer spending is down, margins are tight, and opportunities for innovation or expansion are being stifled,” he said.

MAN’s National President, Otunba Francis Meshioye, while addressing the gathering, urged both state and federal governments to adopt policies that promote local manufacturing.

He emphasized the urgent need to implement the “Nigeria First” policy mandating all government MDAs, contractors, and agencies to patronize made-in-Nigeria products.

“We must support local industries with policy-backed patronage and consequences for non-compliance,” Meshioye stressed.

Inflation

According to him, headline inflation increased to 34.80% in December 2024 due to higher consumer spending attributed to the festive season.

He said the average headline inflation rate for 2024 stood at 33.2 percent, up from 24.7 percent recorded in 2023 while core inflation rose to 29.28% in December 2024 due to escalating transportation and accommodation costs.

However, Nigeria’s headline inflation dropped to 24.48 per cent in January 2025 following the rebasing of the Consumer Price Index, according to the National Bureau of Statistics.

This represented a decline from the 34.80 per cent recorded in December 2024.

However, Daily Trust reports that five months into 2025, Nigeria is yet to achieve the 15 percent inflation target the federal government set for itself.

Onafowokan while lamenting the challenge of inflation, said Manufacturers either had to pass rising costs to consumers or absorb losses to stay in business.

Interest Rate

Last week, the monetary policy committee (MPC) of the Central Bank of Nigeria (CBN) retained the monetary policy rate (MPR), which benchmarks interest rates in the country, at 27.5 percent.

The decision was the third time the CBN has retained the MPR in 2025, following similar calls in February and May.

MAN’s Director General, Segun Ajayi-Kadir said the MPC decision revealed that the contractionary monetary stance is still maintained.

“The persistent increase in the rate over the years has impacted the sector negatively. The expectation of MAN is to have a rate cut that is supported by a robust fiscal policy framework capable of facilitating improved access to long term loans, enhanced productivity and sustained economic growth.

“The same 27.50 percent MPR rate adopted months ago surged the cost of borrowing, as the average lending rate to manufacturers stood at more than 35% as at January 2025.

According to MAN, the rate also had trickle down effects on production cost, impacting prices of finished products, capacity utilization, inventory of unsold goods and competitiveness negatively.

“In 2024 alone, capacity utilization stood at 57 percent, inventory of unsold goods rose to N2,140 billion from N1,141.33 billion recorded in 2023. These impact points combined to create uncertainty, disrupt production and investment plans,” MAN said.

N2.14trn Unsold goods in 2024

24 alone, the inventory of unsold finished goods surged by 87.5 per cent to N2.14 trillion in 2024.

“The proposed increase in electricity tariff is inimical to the competitiveness of Nigerian products and businesses as it will further exacerbate the impact of high cost of production, worsen the current inflationary pressure, aggravate the pressure on the disposable income of the average Nigerian, increase the unsold inventory of manufacturers, erode their profit margin, increase unemployment rate and lead to closure of more private businesses.

“The persistent increase in tariff means that consumers will continue to bear the brunt of the inefficiency in the electricity value chain. As it stands, manufacturers are disadvantaged as the increase cannot be transferred to consumers who are currently battling with low purchasing power.”

The DG said he is not certain that the Federal Government has reached the conclusion that electricity tariff would be increased, insisting that “I hope not.”

He asked the government to commission a review of the performance of the DisCos after the last “unwarranted increase.”

The DG also asked the government to conduct a study on the impact of the increase on the manufacturing sector in particular, and businesses and households in general.

“Sincerely and critically interrogate the so-called cost reflective tariff template of the DisCos, and audit their level of commitment to investment in distribution infrastructure,” he said.

The association reiterated his call for increase in electricity supply from “the abysmal average of 4,000MW of electricity per day for over 200 million people”, saying Nigeria needs “more than 30,000MW of electricity to appreciably meet the growing electricity demands by businesses and households in the country.”

‘Rebased GDP shows industrial sector underperforming’

On Tuesday, MAN asked the federal government to prioritise manufacturing and industrialisation to reflect the real economic situation and gains of the country’s rebased gross domestic product (GDP).

Ajayi-Kadir while reacting to the country’s first quarter (Q1) 2025 GDP growth rate of 3.13 percent, said the improvement suggests that the economy has the potential to recover.

However, he warned that the rebased GDP — mainly driven by improved data from agriculture, services, and the informal sector — should not be mistaken for real progress. “The rebasing confirms that Nigeria’s economy may be statistically larger, but it is not more productive, nor more industrialised.

“While the rebasing exercise reveals a more diversified economy, it also exposes the underperformance of industry, particularly manufacturing, a sector which should be the backbone of Nigeria’s economic transformation,” he said.

Ajayi-Kadir said despite the upward revision, Nigeria’s real GDP growth remains weak, averaging only 1.95 percent between 2020 and 2024.

This, he said, is a sign of the “underlying fragility of Nigeria’s productive base and the capacity of the economy to deliver sustainable and inclusive development”

He said the rebased structure shows industry’s share of the GDP declined from 27.65 percent in the 2010 base year to 21.08 percent under the new 2019 base year.

“This marks a structural shift away from production toward low-productivity service activities,” he added.

He said the government must treat the rebased GDP not as a sign of success, but as “a strong call for structural industrial reforms”.

“Nigeria must re-industrialise to achieve inclusive growth, build export capacity, and reduce dependence on primary commodities and informal activities,” he said.

DAILY TRUST.