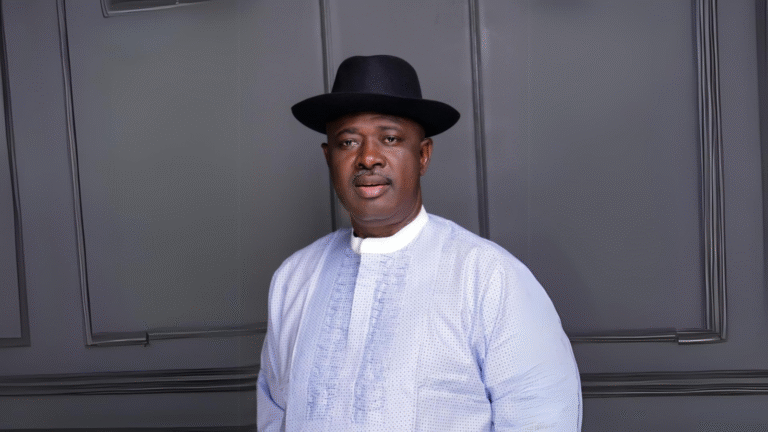

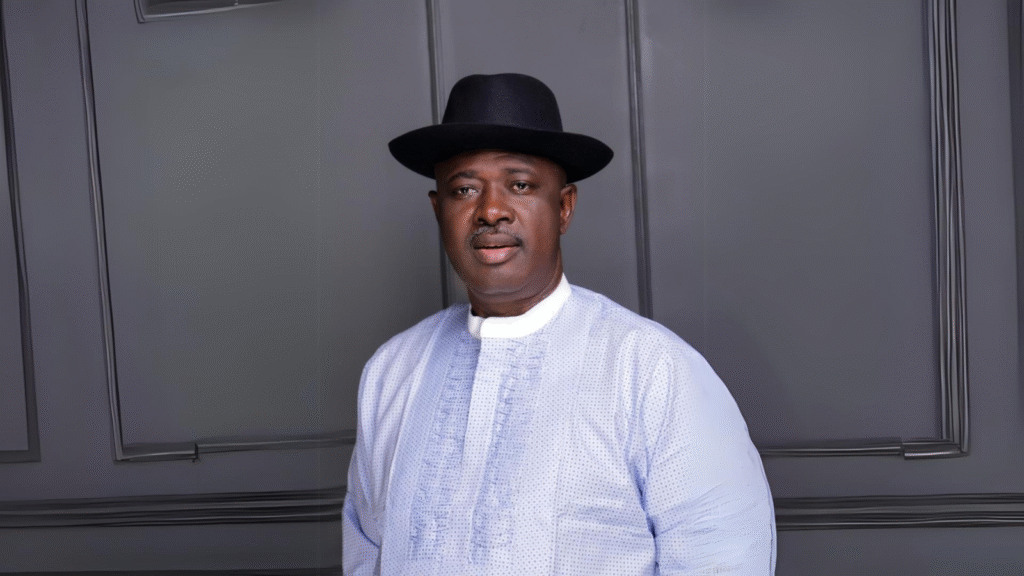

The Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, has stated that Nigeria achieved a major investment breakthrough in 2025 with the signing of 28 new field development plans, valued at $18.2bn, which carry an estimated production potential of 1.4 billion barrels of oil.

Lokpobiri disclosed this on Tuesday in Abuja while delivering his ministerial address at the opening ceremony of the 9th Nigeria International Energy Summit 2026, saying Nigeria had emerged as Africa’s leading destination for oil and gas investments, with four of the seven major Final Investment Decisions announced across the continent between 2024 and 2025 taken in the country.

The Nigeria International Energy Summit is the Federal Government’s official annual platform for energy policy dialogue, investment promotion, and innovation. The ninth edition of the summit is themed “Energy for Peace and Progress: Securing Our Shared Future.”

According to the minister, the development was not accidental but the outcome of deliberate reforms, improved policy clarity, and stronger governance, which have helped to restore investor confidence in Nigeria’s oil and gas sector.

He added that the renewed inflow of capital signalled Nigeria’s return to the global energy investment map after years of stalled projects and declining output, stressing that recent fiscal, regulatory and operational reforms were beginning to yield measurable results.

Lokpobiri said, “I want to talk first about Nigeria; our successes, our renewed readiness, the reforms we have implemented, and then put that in the context of Africa, because our fortunes are tied together.

“In 2025 alone, 28 new field development plans worth $18.2bn were signed, with the potential of 1.4 billion barrels of oil. Between 2024 and 2025, of the seven major FIDs announced across Africa, four were in Nigeria. This did not happen by accident; it is the result of steady work, policy clarity, and better governance. These are facts, not rhetoric, showing that Nigeria is once again a magnet for serious business. Our investment climate in Nigeria allows for free movement of capital.”

Lokpobiri recalled that when the current administration took office, Nigeria’s upstream sector was in distress, with declining production, investor apathy, and an absence of major new projects.

“That Nigeria possesses an enormous hydrocarbon endowment, and a geography that combines deepwater, shallow, and onshore acreages, is a fact. But resource richness alone is not enough. What makes Nigeria now different is the legal, regulatory, financial, and structural transformation we are delivering. Because ‘investment-ready’ means more than just having reserves; it means having clarity, predictability, efficiency, incentives, and alignment.

“When this government started, this sector was struggling, production and capital flight, and investment had stalled. For more than a decade, there were no major final investment decisions on new projects. Investors were cautious, and confidence was lacking. That was our reality,” he narrated before a distinguished audience, including Gambia’s President, Adama Barrow.

He attributed the reversal of this trend to the full implementation of the Petroleum Industry Act, which he said provided a stable fiscal framework, clearer licensing processes, stronger regulation, and predictable contract terms.

The minister added that cost pressures in the upstream sector were also addressed through the Upstream Petroleum Operations (Cost Efficiency Incentives) Order 2025, which grants tax credits and lowers unit operating costs for producers.

Lokpobiri said the launch of Project One Million Barrels in October 2024 had delivered tangible results within a year, lifting crude oil production to between 1.7 million and 1.83 million barrels per day, representing an increase of about 20 per cent over previous output levels.

“We launched ‘Project One Million Barrels’ in October 2024. In less than a year, production rose to between 1.7 and 1.83 million barrels per day, up by roughly 300,000 barrels in July 2025 alone. The number of active rigs jumped from a paltry 14 in 2023 to over 60 as of today. These are signs that the reforms are working, that idle assets are being activated and existing assets are being optimised,” he said.

Lokpobiri also highlighted the successful completion of long-delayed asset divestments by International Oil Companies, which transferred onshore and shallow-water assets to Nigerian firms.

He noted that the divestments had added about 200,000 barrels per day to national output and were concluded in record time under President Bola Tinubu’s leadership.

However, Lokpobiri admitted that some local policy missteps had created fresh challenges, noting that Nigeria’s oil and gas service sector continued to face structural constraints, particularly within the engineering, procurement, and construction segment.

He said a misinterpretation of the Nigerian Oil and Gas Industry Content Development Act had encouraged the rise of “briefcase EPC companies,” forcing out experienced international contractors while sidelining competent indigenous firms.

Lokpobiri said Africa’s annual $120bn hydrocarbon import bill represented a lost opportunity, calling for stronger support for the African Energy Bank, headquartered in Nigeria. “If we do not mobilise resources to solve Africa’s energy problems, our misery will increase as our population grows. The responsibility is ours and ours alone,” he said.

Meanwhile, the Independent Petroleum Producers Group has called for urgent reforms to streamline industry fees, reduce bureaucracy, and improve access to long-term capital to sustain growth in Nigeria’s oil and gas sector.

Delivering a keynote address at the event, the IPPG Chairman and Aradel Holdings CEO, Adegbite Falade, said the summit would be “deeply engaging, thought-provoking, and solution-driven,” adding that the global energy landscape was being reshaped by conflicts, shifting alliances, and growing energy insecurity.

“In today’s interconnected world, energy has no borders. Shocks in one region affect people across continents, and Africa, including Nigeria, is not shielded from these pressures,” Falade said.

He noted that Nigeria’s oil and gas sector had recorded significant growth, highlighting that for the first time, indigenous producers and independents now account for more than 50 per cent of national production. He attributed this to improved export pipeline availability, reduced crude losses, and stronger local participation.

“We must continue to create an industry that allows private capital to drive mainstream infrastructure development. Without this, we cannot bridge the massive gap in potential that exists in our contribution to the nation’s GDP,” Falade said.

“To achieve this, we must reduce bureaucracy, streamline industry fees and related charges to keep operators competitive. Our sector currently operates at significantly elevated costs compared to other non-shared jurisdictions. Access to long-term, affordable capital must also improve.”

The PUNCH reports that the consensus of stakeholders at the event was that Nigeria’s oil and gas sector is on a strong recovery path, driven by policy clarity, regulatory reforms and strategic investments, and that sustained collaboration between government, indigenous companies and international partners is essential to consolidate growth, expand domestic energy access and position the country as a regional and global energy hub.

PUNCH.