Nigeria’s gross profit from crude oil and gas sales plunged by N824.66bn in 2024 despite a rebound in oil production, figures from the latest Budget Implementation Report for the fourth quarter of 2024 released by the Budget Office of the Federation have shown.

Data from the report revealed that gross profit from crude and gas sales fell to N1.08tn during the year, from N1.90tn in 2023, representing a 43.32 per cent decline.

The 2024 performance was also 26.3 per cent below the government’s budgeted target of N1.46tn, underscoring the persistence of weak fiscal inflows from the petroleum sector despite policy reforms aimed at boosting revenue.

The data indicated that the total oil and gas revenue before deductions stood at N15.07tn in 2024, against a budget of N19.99tn. This means that actual inflows fell short of the budget by N4.93tn or 24.65 per cent.

Compared with the previous year’s total of N8.36tn, however, oil and gas inflows almost doubled, showing an 80.33 per cent improvement. The PUNCH observed that the year-on-year increase was largely driven by stronger receipts from royalties, penalties, and exchange rate gains following the unification of the naira, rather than from higher crude export volumes.

The quarterly pattern showed that oil receipts rose from N3.35tn in the first quarter to N3.91tn in the fourth quarter, but remained consistently below the projected quarterly average of N4.99tn.

This underperformance reflects both lower-than-expected realised prices and production shortfalls relative to budget assumptions. Nigeria’s crude output fluctuated between 1.4 and 1.6 million barrels per day, below the 1.78 million barrels per day target used in the 2024 budget.

Despite being the country’s traditional fiscal anchor, gross profit from crude oil and gas sales accounted for only about eight per cent of total oil and gas revenue in 2024, highlighting the structural shift in government earnings toward taxes, royalties, and penalties.

The Petroleum Profit Tax and Company Income Tax on gas operations brought in N6.00tn, representing nearly 40 per cent of all oil inflows, while oil and gas royalties alone generated N6.99tn—an increase of 179.74 per cent compared with N2.50tn in 2023. Officials attributed this rise to improved compliance monitoring and the conversion of marginal fields and assets under the Petroleum Industry Act.

Other revenue streams also performed strongly. Gas-flaring penalties yielded N391.26bn, up 178 per cent from N140.54bn in 2023, even though the budget had made no provision for this category.

Incidental oil revenue from royalty recovery and marginal field settlements climbed to N347.75bn from N155.99bn a year earlier, a growth of 122.93 per cent, while miscellaneous income, mainly from pipeline fees, increased to N35.2bn from N16.38bn.

One of the most significant contributors to the apparent growth in oil revenue was the exchange-rate gain, which soared to N4.24tn in 2024 from N791.88bn in 2023—an increase of over 435 per cent. The surge followed the naira’s steep depreciation after exchange rate liberalisation, which inflated dollar-denominated oil earnings when converted into local currency.

After accounting for all deductions, net oil revenue for 2024 stood at N12.95tn, against a budget target of N16.98tn, a difference of N4.03tn or 23.74 per cent. When compared with the N4.82tn realised in 2023, the 2024 outcome represents a 168.83 per cent increase.

While the figures appear positive on paper, The PUNCH observed that much of the gain came from exchange-rate effects rather than improved operational performance or higher crude proceeds.

Oil production surge

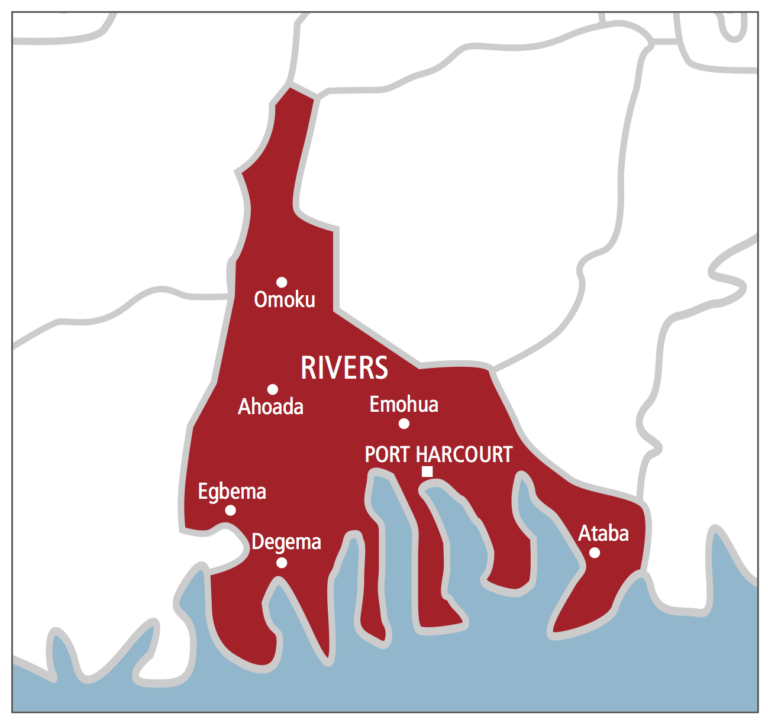

Nigeria’s crude-oil production inched up in 2024, with data from the Nigerian Upstream Petroleum Regulatory Commission showing that output rose to 442.21 million barrels, compared with 392.66 million barrels in 2023.

The increase of 49.55 million barrels, or 12.62 per cent, marked a modest recovery in upstream performance following three years of volatility and output disruptions. On a daily-average basis, Nigeria pumped about 1.43 million barrels per day in 2024, up from 1.27 million barrels per day the previous year.

The gradual improvement reflected reduced vandalism along major crude-evacuation corridors, improved coordination among joint-venture partners, and incremental barrels from marginal-field operators licensed under the Petroleum Industry Act.

Monthly data showed that production stabilised after the second quarter. Average output slipped briefly to 1.29 million bpd in April 2024—when several terminals underwent maintenance—but recovered to 1.49 million bpd in December, the highest level of the year. The year-end figure was 12 per cent higher than December 2023’s 1.33 million bpd, signalling a firmer footing heading into 2025.

Total liquids—comprising crude oil and condensates—amounted to 492.34 million barrels in 2024, compared with 451.09 million barrels in 2023, translating to a 9.14 per cent increase.

Crude oil made up roughly 89.8 per cent of total liquids, while condensates contributed the remaining 10.2 per cent. The condensate share slipped slightly from 2023, underscoring that the recovery was driven mainly by higher crude throughput rather than condensate output.

Despite the increase, Nigeria’s output still lagged its fiscal target of 1.78 million bpd, reflecting lingering infrastructure constraints, under-investment, and crude theft.

The shortfall means that actual production achieved only about 80 per cent of the government’s projection, a key reason oil-revenue inflows missed the 2024 budget despite nominal gains from exchange-rate revaluation.

Experts have said that maintaining production above 1.6 mbpd will depend on stronger security along oil corridors, timely field redevelopments, and consistent application of the Petroleum Industry Act reforms.

The NUPRC has pledged to enhance metering accuracy, tighten compliance enforcement, and foster collaboration with operators to stabilise supply.

Meanwhile, NNPC’s remittances to the government have repeatedly come under scrutiny by local and international organisations. Earlier this year, the World Bank said NNPC was remitting only half of the financial gains from the removal of petrol subsidies due to debt arrears. It said that, out of the N1.1tn revenue from crude sales and other income in 2024, NNPC remitted only N600bn, leaving a deficit of N500bn unaccounted for.

“Despite the subsidy being fully removed in October 2024, NNPCL started transferring the revenue gains to the Federation only in January 2025. Since then, it has been remitting only 50 per cent of these gains, using the rest to offset past arrears,” the World Bank noted.

The Washington-based lender further noted that “NNPCL was the only laggard… largely due to the implicit PMS subsidy, which remained in place until the end of September 2024. Although the subsidy was fully removed on October 1, 2024, NNPCL did not start transferring the resulting revenue gains to the Federation until January 2025. From that point, it began remitting 50 per cent, with the other half being used to settle past arrears.”

The PUNCH earlier reported that the Federal Government, through the Federal Accounts Allocation Committee, extended the ongoing probe and reconciliation of payments made by revenue-generating agencies, including the Nigerian National Petroleum Company Limited, to December 2024, following unresolved discrepancies in remittances.

According to documents from the October 2025 meeting of the Federation Account Allocation Committee, obtained by The PUNCH, the extension was approved after the sub-committee in charge of the monthly reconciliation meetings reported that several outstanding payments were yet to be fully reconciled.

To ensure accurate reporting and eliminate discrepancies, the NNPCL has been mandated to provide its actual remittance figures in place of previously submitted estimates.

“Also, the second phase of the reconciliation extended the period to December 2024, and NNPCL was mandated to provide its actual figure to replace the estimates. The Sub-Committee awaits the outcome of the report of the Technical Reconciliation Committee meeting conveyed by the Ministry of Finance,” the FAAC document added.

The sub-committee also noted that it is awaiting the outcome of the report from the Technical Reconciliation Committee convened by the Federal Ministry of Finance to harmonise submissions from all relevant agencies.

The review follows findings by Periscope Consulting, a firm engaged by the Nigeria Governors’ Forum, which had earlier accused the state oil company of withholding crude oil proceeds and other statutory revenues due to the Federation Account during the period.

According to the report titled “Update on NNPC’s Alleged Under Remittances to the Federation Account of $42,373,896,555.00”, the company had earlier requested a two-month grace period to respond to findings by Periscope Consulting, a firm engaged by the Nigeria Governors’ Forum to investigate alleged revenue shortfalls between 2011 and 2017.

“During the Sub-Committee’s meeting, NNPCL reported that it had submitted its response on October 10, 2025, as requested. The ad hoc committee set up to examine the issue was mandated to study the submission and report back. This assignment is still a work in progress,” the FAAC document stated.

The situation has been compounded by NNPCL’s failure to remit any interim dividends into the Federation Account in 2025.

Experts react

Energy experts expressed concern over the decline in crude oil earnings despite a rebound in oil production, describing the development as a sign of poor transparency, weak data integrity, and structural inefficiency in the petroleum sector.

An Energy Law Professor at the Lagos State University, Prof Dayo Ayoade, said the decline in earnings despite improved production showed that the country’s oil industry was still plagued by poor record-keeping and weak accountability.

He explained that the removal of petrol subsidy had no direct link with crude oil proceeds because subsidy payments affected refined petroleum products, not crude exports.

“Subsidy has nothing to do with crude oil,” he said. “Our revenue is based on how many barrels of crude we are selling in the international market. But when you look at the data, it’s not adding up. We are told production is up, but the numbers are not reflecting that improvement.”

He said part of the reason Nigeria was not earning enough from crude exports might be due to inaccurate production data, unrecorded cargoes, and the persistence of oil theft.

“The numbers are not showing that we have that much crude in the market,” he said. “If we were truly exporting more, then our receipts should have gone up, not down.”

According to him, the current situation suggests that the country’s oil-export system remains opaque. “This complicated picture shows that there are still poor statistics, poor exporting obligations, and weak monitoring,” Ayoade said. “We need to be more honest about the numbers so that we can plan properly for tomorrow.”

He added that Nigeria must also confront the larger structural problem of exporting crude and importing refined products at high cost. “We sell crude oil to people who refine it and sell it back to us at a premium. That is not sustainable,” he said. “We are slowly getting there with local refining, but we need transparency and better planning.”

Ayoade also warned that the global energy transition posed a risk to Nigeria’s revenue prospects if reforms were not accelerated. “There’s a need for industrial support to ramp up production,” he said. “Whether we like it or not, global demand for crude will eventually decline, and we need to prepare for that shift.”

The Chief Executive Officer of AHA Strategies and oil and gas expert, Mr Ademola Adigun, also blamed the drop in oil earnings on opaque crude-for-cash agreements and undisclosed loan repayments that have tied up part of Nigeria’s oil output.

He said some of the government’s oil barrels were already committed to debt settlements and forward-sale contracts, which reduced the actual volume of crude that brought fresh revenue into the Federation Account.

Earlier in October 2024, The PUNCH reported that the Nigerian National Petroleum Company Limited pledged 272,500 barrels per day of crude oil through a series of crude-for-loan deals totalling $8.86bn.

Pledging 272,500 barrels daily means that about 8.17 million barrels of crude would be used for different loan deals by the national oil firm on a monthly basis. This was according to an analysis of a report by the Nigeria Extractive Industries Transparency Initiative and the NNPCL’s financial statements.

Reacting, Adigun said, “Some of our crude is already tied up in loan agreements. The problem is that Nigeria doesn’t know the full details of these transactions because there’s little transparency around them.”

Adigun explained that several crude-backed projects, such as Project Gazelle, were carried out without proper public disclosure or parliamentary scrutiny. He added that the Nigeria Extractive Industries Transparency Initiative should step up its audits to reveal how much of the country’s crude was being used for debt repayment or swap deals.

Development economist and Chief Executive Officer of CSA Advisory, Dr Aliyu Ilias, said the discrepancy between higher oil production and lower revenue indicated that certain domestic transactions might not have been captured in the Budget Office report.

He said some crude supply arrangements—particularly those involving the Dangote Refinery and other domestic swap deals—might be underreported or excluded from the federal revenue computation.

Ilias added that Nigeria’s crude trading structure had become increasingly complex, involving swaps and oil-to-naira exchanges that might not be fully accounted for.

He urged the government to commission a separate study on how such short-term crude transactions affect overall fiscal performance. “Oil revenue remains the mainstay of the economy,” he said. “Government cannot afford to keep this level of opacity if we are serious about rebuilding investor confidence.”

The Director of the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said the sharp fall in profit from crude oil and gas sales despite rising output and stable prices was likely the result of forward-sale agreements executed in previous years that continued to drain current revenue.

He recalled that during the tenure of the former Central Bank Governor, Godwin Emefiele, several forward-sale deals were signed to raise emergency funds when the government faced fiscal pressure.

“During the Emefiele years, Nigeria committed a lot of its crude up front,” he said. “Those forward sales are still eating into our current earnings.” He explained that the combination of forward sales, opaque trading, and off-balance-sheet transactions had distorted the relationship between production and earnings.

Yusuf, however, acknowledged that transparency and professionalism within the Nigerian National Petroleum Company Limited had improved under the current administration of Bayo Ojulari.

“Under the new management of the NNPCL, there’s better professionalism and openness,” he said. “But before now, the company was not known for transparency in oil trades.”

He added that the government must disclose the full details of its crude swap and forward sale agreements to restore confidence in oil revenue reporting.

PUNCH.