The National Insurance Commission,NAICOM, has charged insurance companies to take cognizance of the fact that industrialization and economic development have triggered a spectrum of environmental externalities and social impacts resulting in risk management and other issues.

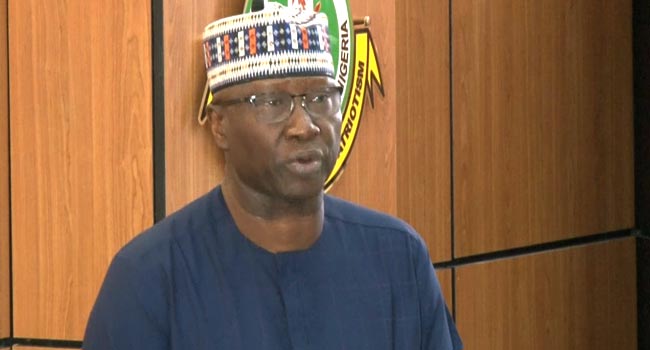

The Commissioner for Insurance, Mr. Olorundare Sunday gave the charge at the 2022 Insurance Directors Conference held in Lagos on Friday.

“Distinguished participants, we must take cognizance of the fact that Industrialization and economic development have given rise to a wide

spectrum of environmental externalities and social impacts bringing to the fore issues such as board structure, shareholder rights, business ethics, risk management, incentives and executive compensation”

He stated that, the Conference themed “Transforming the Insurance Industry Through ESG Principles: Directors’ Roles” is specially couched in view of the fact that the world is going through rapid changes economically, socially, and environmentally and, the need to bring Directors of insurance entities to speed on thesedevelopments to enable sustainability.

“The role of board of directors in the survival and transformation of their establishments can never be over emphasized thus, this Annual programme is meant to apprise the directors with the developments in the industry and also equip them with necessary knowledge that will enhance the value of their companies” he added.

He also noted that “In the financial services industry, there is an increasing realization that

sustainable practices have a positive potential to save costs, increase revenues, reduce risks, develop human capital and improve access to

finance thus, ignoring sustainability issues increases legal and reputational risk”.

However, Mr. Olorundare encouraged the insurers to take the bull by the horns and make harness challenges to opportunities.

“However, wherever there is a challenge, there is an opportunity. And all the sources of disruptions can be harnessed to become a source of growth for insurers. While no one can predict exactly what insurance might look like in a decade, insurers can take several steps now to prepare for these changes”

“The insurance industry globally is continuously undergoing profound changes; we must admit that the disruption we are faced with is not just digital but also harsh market conditions, demanding customers, innovative new market entrants and regulations which are also some of the forces transforming the insurance industry”